The dates in this blog post might be outdated. For the latest updates on Northern Ireland visit our blog page

As of 1 January 2021, import declarations are applicable to goods movement from GB to Northern Ireland. This article provides information about whether goods moving between the UK and Northern Ireland are subject to duties and includes links to guidance tools that will help you determine what is required.

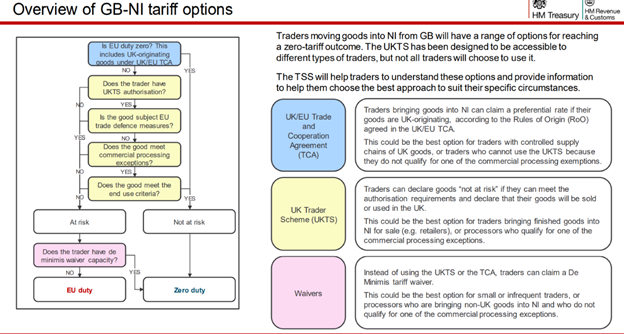

Preferential treatment and “at risk” vs “not at risk” goods

The rules of origin and the concept of goods “at risk” of onward movement to the EU determine whether a preferential treatment applies. No duties must be paid if preferential treatment is claimed, either for goods of UK origin or good of EU origin (for goods of EU origin they must come from a customs warehouse where they were under customs control). These goods automatically enter Northern Ireland tariff-free and the trader does not need to consider whether the goods are “at risk”. However, duties remain applicable to non-EU/non-UK-originating goods.

- For goods “not at risk”, the applicable EU tariff is zero as the preferential treatment applies.

- For goods “at risk”, the EU tariff applies.

Goods always at risk:

- Goods subject to commercial processing in Northern Ireland and where the additional processing criteria is not met

- Goods from outside the UK/EU where the EU duty is more than 3% greater than the UK duty

Goods automatically NOT at risk:

- Goods where the UK duty is equal to or higher than the EU duty

Also, so-called "goods movement declarations" will apply to goods sent from GB to Northern Ireland. No export declarations are required in GB for movements to Northern Ireland.

What you need to know before you move goods between Northern Ireland and non-EU countries (including GB)

- If you plan to move goods between Northern Ireland and non-EU countries (including GB), you’ll need an EORI number that starts with XI.

- If you plan to move goods between Northern Ireland and GB, or bring goods into Northern Ireland from outside the UK, you can sign up for the free Trader Support Service.

- If you bring goods into Northern Ireland, you can find out how to make sure the right tariff is applied to the goods you bring from Great Britain, including whether you can claim preferential rates of duty on goods covered in the UK’s deal with the EUor from countries outside of the EU and the UK.

- If you import goods regularly, you can apply for a duty deferment account to delay paying most customs charges.

- To understand any duty or other measures that apply to your goods, you’ll need to find the right commodity code to make your customs declaration when you bring goods in or send goods out of Northern Ireland.

Bringing or receiving goods into Northern Ireland

If you’re a UK-based business bringing or receiving goods into Northern Ireland, check what declarations may need to be made.

Check the origin of your goods. This may allow an EU or UK preferential arrangement to apply.

For goods moving into Northern Ireland from outside the EU and UK, EU Tariff Rate Quotas will not be available. Gov.uk has provided a helpful new guidance tool to check if you need to pay a tariff on goods brought into Northern Ireland from Great Britain.

Use the commodity code to check what duties and measures may apply to your goods. This will show if you need any extra documentation or measure codes on your declaration. If a commodity code indicates the need for a meursing code within the EU tariff, this will need to be included on all Northern Ireland declarations.

Trader Support Service (TSS)

The Trader Support Service provides extensive support to businesses engaging in new processes under the Northern Ireland Protocol. It is a free service, available to all traders moving goods between Great Britain and Northern Ireland and importing goods into Northern Ireland from the rest of the world.

As stated above, import declarations are required for the goods movements from GB to Northern Ireland.

There are different forms of declarations to be completed, including:

- Safety & Security (ENS) declarations

- Simplified Frontier declarations

- Supplementary declarations

- Full import declarations

TSS provides a portal for digital submission of these declarations. Detailed user guides can be found here.

C4T’s customs compliance software, CAS, supports automated filing for all declaration types between GB and Northern Ireland. With our double-filing functionality, import and export declarations are created and filed with one single message. All legal requirements are kept up-to-date within CAS and declaration data is validated before it is sent, ensuring your goods pass through customs without delay. Would you like to bring your customs operations in-house and reduce your cost per transaction by 10-20x?

Useful links:

Trader Support Service User Guides (how to register, declarations requirements, API reference etc.)