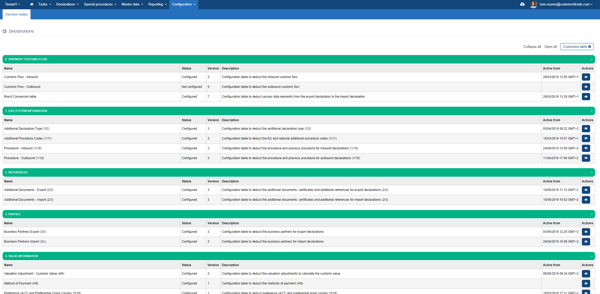

As part of our new fast onboarding process, we added decision tables that help enrich the data you provide with the proper information. The tables can be easily configured and then used for all flows.

For this example, let’s assume we are shipping goods from Belgium to the UK, post-Brexit. You would provide a small data set with typical invoice information of the outbound shipment. You would then use our Brexit Conversion decision table.

This template enriches the information you provided with the relevant master data to create the Belgian export declaration. Once CAS receives a release from the Belgian customs authorities, the system automatically invokes the relevant steps to receive the goods in the UK.

This single message, double filing feature supports end-to-end customs flows, allowing you to file an import and export declaration with one single message. You will then move on to the next decision table—Customs Flow Inbound—to select one of the three flows that will be supported by HMRC: Prelodge, Transitional Simplified Procedure, or Customs Freight Simplified Procedure. We will talk about these in one of our next blog posts: New Updates to CAS: Approved HMRC Customs Procedures.

Fast onboarding and single message, double filing, are just two new features that further accelerate the customs process.